Bank Reconciliation¶

The Bank Reconciliation feature allows you to reconcile bank statements with your PropMan records. This is an important step in maintaining accurate financial records and identifying potential issues early. It also ensures that the Management Report and other reports are accurate.

Overview¶

Bank Reconciliation helps you:

Match bank transactions with PropMan records

Identify discrepancies between bank and book balances

Track outstanding checks and deposits

Maintain accurate financial records

Auto-Reconciliation¶

If you have setup Plaid integration or BAI files, PropMan will automatically synchronize bank balances and your Buildings’ capital accounts periodically. PropMan will also pull transaction data from both of these sources and use Machine Learning to match transactions to PropMan records and Gl Accounts.

You train the Machine Learning model by manually matching transactions to PropMan records and Gl Accounts. It gets smarter with each match.

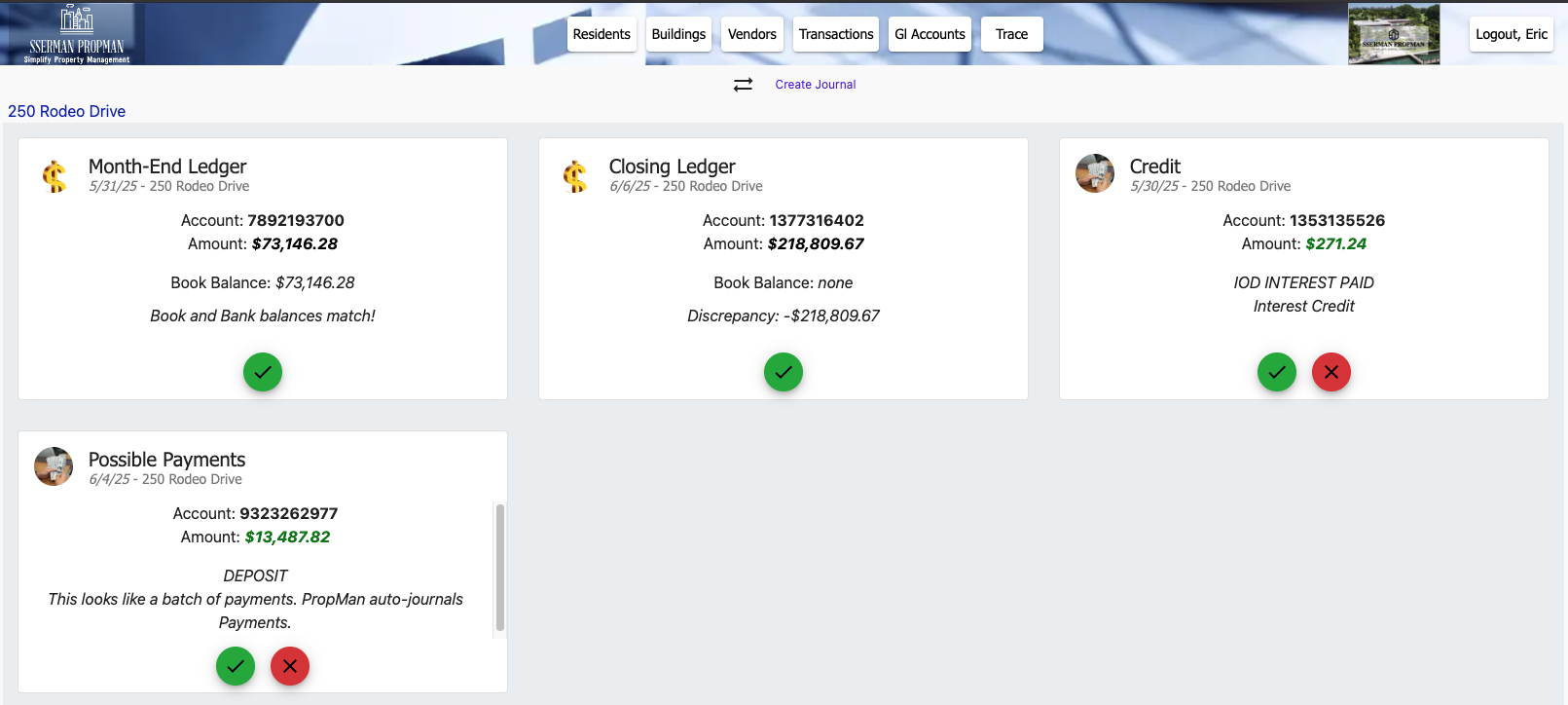

The Auto-Reconciliation screen with some open transactions and suggestions

The Auto-Reconciliation screen will show you:

Month-End ledger breaks

Daily closing ledger breaks

Open credit/debit transactions that have not been matched to a PropMan record

Suggestions for skipping transactions that are identified as possible Resident payments

Checks requiring clearing

Hovinging over the ✓ and X icons will open a tooltop explaining the action, and clicking it will perform the action.

PropMan will auto-clear checks to Vendors as long at the check information from the bank matches the check information in PropMan. If it can not be auto-cleared, the check will appear on this screen and require manual review.

See the Clear Checks screen and Trace for more information about cleared and clearing Checks.

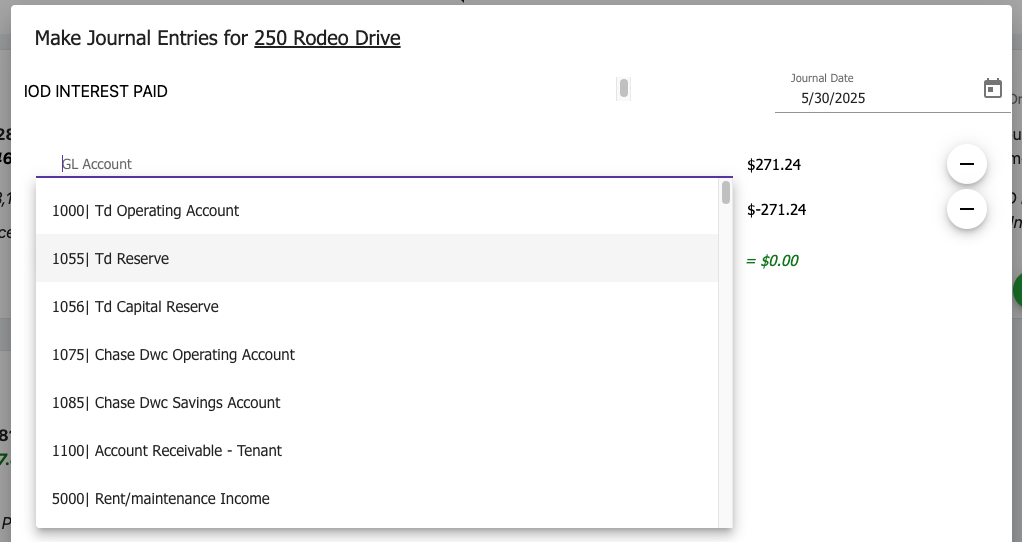

A Journal Entry screen launched from the Auto-Reconciliation screen

The most common action is to journal the transaction, and in doing so, you will provide a GL Account which trains the Machine Learning model.

Reconciliation Process¶

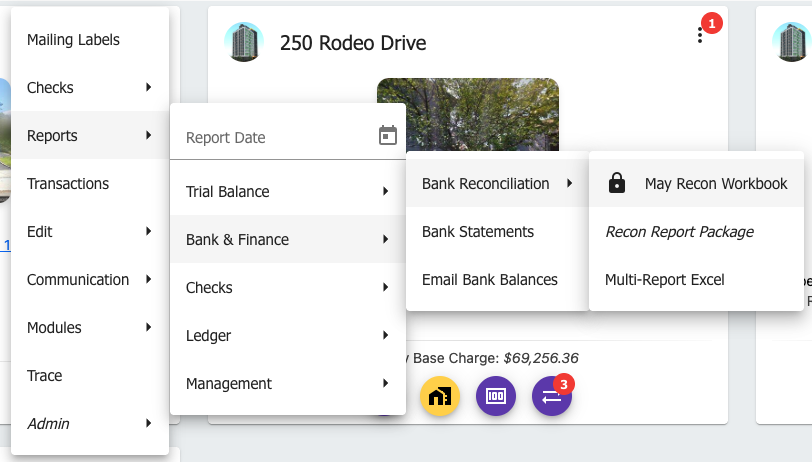

A red badge will appear over the dropdown menu of the Building card with a count of the number of fiscal months requiring reconciliation. When this badge is present, the Bank Reconciliation menu will show the previous month’s workbook without a lock icon.

The open menu showing the Bank Reconciliation options

Access the Bank Reconciliation screen

Select the bank account and statement period

Review and match transactions

Resolve any discrepancies

Complete the reconciliation

Note

Regular bank reconciliation is essential for maintaining accurate financial records and identifying potential issues early.

Recon Report Package¶

The Recon Report Package is a set of PropMan reports that are considered important to completing the reconciliation process.

The reports will be merged into a single PDF and opened in a new tab. If a bank statement is uploaded, it will be opened in another tab.

Bank Reconciliation - A summary of the reconciliation process

Outstanding Checks - A list of checks that have not been cleared

Cleared Checks - A list of checks that have been cleared this month

Statement of Disbursements - The list of disbursements for the fiscal month

General Ledger - The general ledger for the fiscal month

See Reports for more information about these reports and more.

Recon Workbook¶

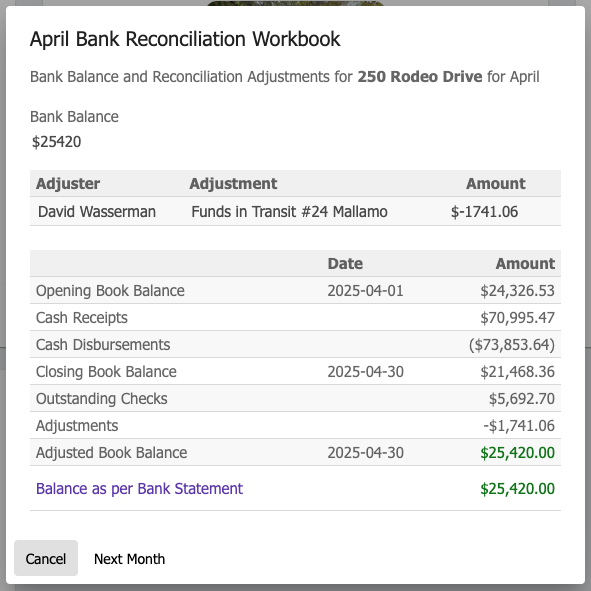

Complete Recon Workbook with the fiscal month closed

The Recon Workbook is a tool that allows you to reconcile your bank statements with your PropMan records.

Clicking Outstanding Checks will open the Clear Checks screen.

It is suggested that you review the cleared and outstanding checks against the bank statement.

Clicking Balance as per Bank Statement will open the Bank Statements screen with appropriate bank statement if it’s been uploaded, or the option to upload a new bank statement if not.

Once the Adjusted Book Balance and Balance as per Bank Statement are equal, you can click Close Fiscal Month button to save and close the fiscal month. After closing, PropMan will block any new transactions from being posted to the fiscal month.